Checks Clearing Process

Automation Solution

Despite the trend toward a cashless society, checks are still very much in use. While they play an important role, they can also create a major hassle. In fact, checks clearing process consumes employees’ time in routine tasks. Also, recovering funds from bounced checks can be costly and time-consuming, impeding cash flow and limiting the bottom line.

Take the hassle off your hands with Sumerge’s Checks Collection and Clearance solution. Our automated end-to-end platform captures, digitizes, and automates check operations while seamlessly integrating with central clearing houses. You save time, eliminate hassles and get paid — fast.

Checks Clearing Process - Solution Benefits

-

Rapid Processing for Happy Customers

Real-time, highly personalized customer communications using existing client info and rapid transaction cycles

-

Fast and Steady Income Stream

Automation accelerates the check collection, clearing, approval and rejection cycles

-

Business Protection on All Fronts

Guaranteed regulatory compliance with real-time monitoring and automated validation to reduce chances of fraud

-

Key Details for On-the-Spot Decision Making

Full visibility provides optimum insights into information processing and transaction efficiency

Checks Clearing Solution Capabilities

Check Image Capturing

Optical Character Recognition (OCR) and Intelligent Character Recognition (ICR) provide secure and seamless capture

Workflow Automation

Optimized check processing operation reduces data entry and duplication errors

Check Case Management

Management of unstructured processes and ad hoc tasks for seamless collaboration

Integration with Core Banking

Information exchanged with core banking system for efficient check settlement

Automated Compliance

Automatic regulatory compliance review with credit history, AML status and blacklists

Reporting & Dashboards

Automatically generate check presentment and return reports

Internal Checks Clearing Solution

Latest Case Study

Sumerge has helped one of the leading banks automate their internal checks collection and clearing process. To begin with, the bank’s core system runs over AS400 and our solution is not replacing the module of checks processing. However, the purpose of our platform is to automate the internal workflow required before proceeding with debiting or crediting checks. In addition, our solution provides electronic archiving as well as it helps expedite search operations.

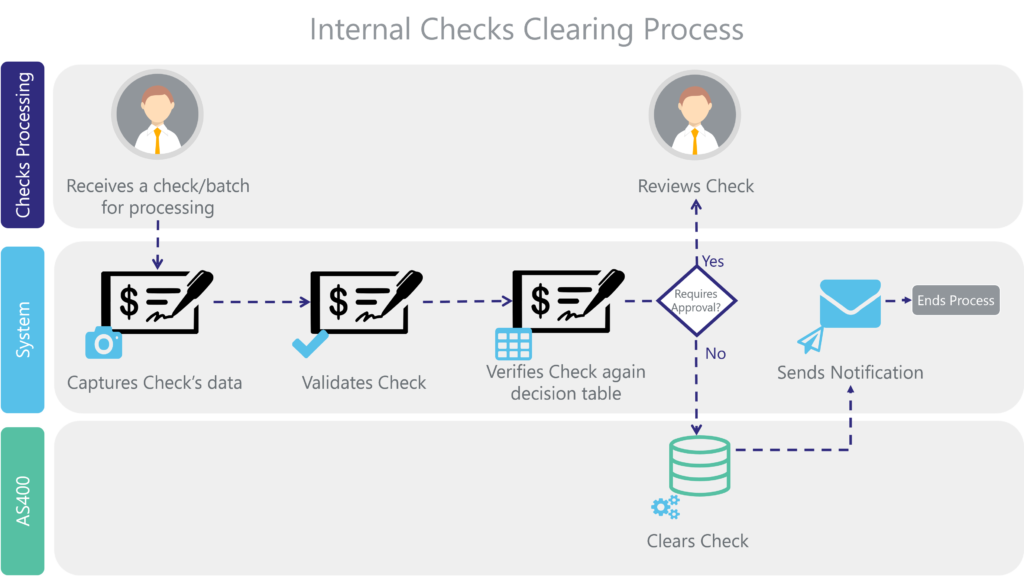

For instance, the diagram illustrates one of the automated processes. The platform has transformed the internal workflows leveraging IBM Automation technologies. Employees were no longer required to perform routine tasks such as validating checks, verifying signatures, etc. After going live, this solution has helped the bank cut costs by 60%.

Interested to Learn More? Book Now a Free Consultation Session with our Banking Consultants

More on Banking Solutions

You May Also Be Interested In

RPA Use Cases in Banking | Where Can I Leverage RPA?

- Posted by Adham Jan

- On May 4, 2020

Robotic Process Automation (RPA) Robotic Process Automation (RPA) is quickly gaining traction across many industries. According to Forrester, the market will reach $2.9.

Transform Your Customer Onboarding Experience

- Posted by Adham Jan

- On February 3, 2020

Every online customer interaction with your banking institution is a chance to make an impression. The experience of signing up for a...

How the GDPR Affects Financial Institutions

- Posted by Adham Jan

- On August 23, 2019

The General Data Protection Regulation, or GDPR, is the set of regulations adopted by the European Union to dictate how personal privacy...

What our customers say

Sumerge is one of the best companies I have dealt with. The team is very professional, respectful, punctual and committed to delivering the contracted project on time

Sahar Salah,

Vice President, Head of IT, Bank ABCSumerge helped us to seamlessly implement a daily vouchers solution where the team provided an exceptional effort to solve any migration issues and finish the implementation with zero data loss or security issues

Shaarawy Mohamed,

IT Infrastructure services Manager, FABWe used Sumerge’s consultancy and experience to implement our Self-Service Portal as they are the best team in the region to implement and use IBM Technology

Ahmed Abd El Hady,

IT Division Manager, TE-DataThankfully with Sumerge’s ECM solution we now rely on our electronic documents and moved our physical collateral documents to a safe fireproof warehouse, as we no longer need the documents onsite anymore

Tamer Emam,

Head of IT, EMRCWith Sumerge we seamlessly implemented automation for our loan appraisal process along with enterprise content management which empowered us to help more citizens find affordable housing more quickly